Call and talk to a Chicago Bankruptcy Lawyer Now:

Gleason and Gleason (312) 445-8825

Phone and Office Appointments available! Evenings and Weekends!

Chapter 7 Special

Only Three Payments of $425 including Attorney Fees and Court Costs. We will file your case with the court and get you protected after first $425 is paid. $850 balance can be split up into 2 monthly payments of $425 or 4 monthly payments of $212.50. Call now and talk to a Chicago Bankruptcy Lawyer.

Flat Fee: Attorney Fees $937 + Court Costs $338 = $1275 Total.

How it works:

Hire Gleason and Gleason as your Chicago Area Bankruptcy Lawyer.

Experience

Troy and Julie Gleason have been bankruptcy lawyers for over 20 years. Specifically, we know the bankruptcy system. We practice 100% bankruptcy law. Nothing else. Significantly, our Chapter 7 success rate is over 99.5%. We can put our experience to work for you.

Affordable

Our flat fee chapter 7 works with most budgets. Only $425 down to get filed and get protected. This allows you to get protected quickly and stop the calls. For Chapter 13 cases we require a small down payment to get filed. Additionally, the rest of the fees are put in the Chapter 13 payment plan.

Attorneys Answer Phones

We like what we do. We like helping people. We can’t provide you with the the best customer service and the answers you need with a call service, answering machine or legal assistant taking messages. Attorney Julie Gleason, Attorney Troy Gleason or Attorney David Gallagher will personally answer your call. All 3 of us are Illinois licensed bankruptcy lawyers. We have years and years of experience. Your call will not be answered by a clerk or paralegal. The NUMBER ONE complaint we hear from people about other lawyers is that they can never get in contact with an actual lawyer at their law firm. That will not happen if you hire Gleason and Gleason.

We Understand How the Bankruptcy Courts Work

Our lawyers appear before all of the Chicago bankruptcy court judges and trustees on a daily basis. In fact, We have handled over 10,000 chapter 7 and chapter 13 bankruptcy cases.

VIP Service

We will file your case as quickly as possible. You are being harassed, sued or garnished. We understand. It is our mission to stop this as soon as possible. Your situation is stressful and we will treat you in a friendly, nonjudgmental and professional way. Over 60% of our new clients were referred by a friend or family member who had a successful case with us.

We Are Local

Gleason and Gleason has 2 convenient locations. Our offices are located in Oak Lawn, Illinois and Bolingbrook, Illinois. We have Phone and Office Appointments available. We are also available Evenings and Weekends.

Chicago Area Chapter 7 Lawyers

Chapter 7 Bankruptcy is regular bankruptcy. Debts which are forgiven include most credit cards, medical bills, utilities, unsecured judgments, repossession’s, personal loans, payday loans. Debts which are not forgiven include child support, tolls, village tickets, taxes less than 3 years old and student loans . There are special rules for taxes older than 3 years old and City of Chicago tickets. You continue making payments on your house and car. A Chicago Bankruptcy Lawyer will guide you all the way.

Chicago Chapter 7 Step by Step

1. Consultation with a Chicago Bankruptcy Lawyer

2. Pre-Bankruptcy Credit Counseling

3. File Bankruptcy Petition with the United States Bankruptcy Court.

4. Automatic Stay comes into effect.

5. Post Filing Financial Management Course.

6. Zoom hearing. You can do it at home or come to our office and do it with us. Either way we are there with you.

7. Court Grants Bankruptcy Discharge

8. Case Closed.

Chicago Bankruptcy Lawyer: Julie Gleason

Over 10,000 people have trusted our bankruptcy lawyers with their cases. I will apply this experience to your case. My Law Firm has a Chapter 7 Bankruptcy discharge rate of over 99.5%. – Julie M Gleason

WE ARE FULLY INSURED

Chicago Chapter 13 Lawyer

Chapter 13 bankruptcy is a repayment plan supervised by the courts. Our Chapter 13 Bankruptcy Attorneys help people who want to pay off their debts over a period of three to five years.

Top Reasons to File for Chapter 13 Bankruptcy

-

You don’t qualify for a chapter 7 bankruptcy.

-

You have valuable assets that need protected.

-

You Can Save your House or Car in Chapter 13 Bankruptcy.

-

You can pay your debts over time.

-

Furthermore, you can file for Chapter 13 Bankruptcy if you have filed a chapter 7 less than 8 years ago.

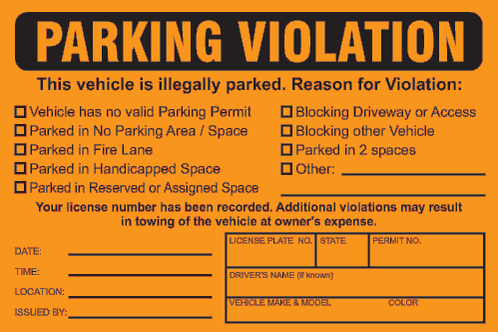

Chicago Parking and Camera Tickets

New Chicago Fresh Start for Chapter 7 Filers

Your tickets (Chicago Only) are split into two groups:

1. Tickets older than 3 years are group one.

2. Tickets newer than 3 years old are group two.

3. A Payment plan is offered based on the original amount of tickets in group 2.

4. Once the payment plan is finished, the tickets older than 3 years old in group 1 and the late fees in group 2 are forgiven!

5. We will set this up for you.

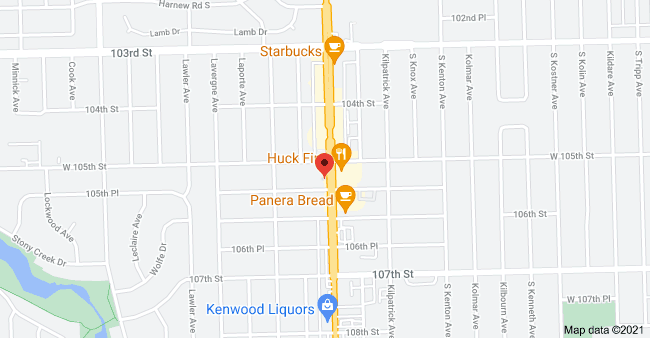

We have offices located in Oak lawn and Bolingbrook. Telephone and In Office Appointments Available. Evenings and Weekends as well.

10522 S Cicero, Oak Lawn, IL 60453

Map

498 W. Boughton, Ste 201, Bolingbrook, IL 60440

Map

BBB A+ Rated

Hello, Mrs. Gleason I have received my discharge papers in the mail. I just wanted to thank you for all of your five years worth of help. My original goal was to stay in my home and I am still here. I have really appreciated you being on my help team. THANK YOU. THANK YOU. again.

I contacted Gleason and Gleason Law Office, after my husband passed away because I had no choice but to file Bankruptcy. They do not charge you an arm and a leg. In addition, the lawyers do everything. They will let you know in advance what the procedure is. Moreover, the attorneys will advise you in advance if you will have complications. They treated me with respect. Additionally, my bankruptcy went smoothly.

A couple weeks after the bankruptcy discharged I found myself in another situation. Mr. Troy and Mrs. Julie Gleason, took my hand and walked me through with ease. I was not charged for the extra work done for me. Even though it took a few months. These are the type of Attorneys that make up for the ones out here bad. If you need a Chicago Bankruptcy Lawyer, I would recommend this Law Firm, in a heart beat, to do your Bankruptcy anytime. They do not stop helping you just because the Bankruptcy discharges. I wish they practiced other areas of the Law, but I assure you, they will recommend someone credible for you. They have my utmost respect and confidence. Troy and Julie, you rock. Thank you for being human… God Bless. – AD

I really wish I could give him 100 stars. Never have I met an attorney so dedicated so patient so kind and also efficient. He knows his stuff that is for sure. He is reasonable on his rates. Each and every time I have reached out to him he has made it his business to contact me the same day. By email and phone he and his office is accessible. I recommend him 1000 percent. – LH

Julie is a lifesaver!

Mr. Troy Gleason, is helpful, provides clarity and walks you through the process and what to expect, he’s very patient as well. Especially for the delayed learner. The location on Cicero provides parking. He’s also easily reachable via phone once your a client. His team is polished and professional. I totally recommend Mr. Gleason – KD

After going to Debt Stoppers and not liking the outcome I contacted G&G in Bolingbrook. My husband and I went to the Bolingbrook office where we meet attorney Troy Gleason. MY HUSBAND AND I HAD ALOT OF QUESTION BUT Troy took his time and explained everything to. He also help of out with other questions we had regarding my husband license. He came to court with us and sat next to us. My sister is still waiting on her attorney from another company to call her back . It has been 3wks. Also, she told him it was an emergency. So I would tell you to go to Gleason and Gleason. And they where cheaper.

Troy is nothing less than AMAZING! He took his time learning my issues, understanding my concerns, and helping me determine the best legal option for my situation. Working with Troy was great, as he was easily accessible and was always willing to answer any questions I had. I am now on the road to making better financial decision and i can not thank Troy and Gleason & Gleason enough!

I was in a tight bind, I had to do something! The creditors had frozen all my accounts, thank God for prepaid cards. My ex told me about Gleason & Gleason, I didn’t want the creditor to take what I had in my accounts I am a single mom of three. I immediately made an appointment to see Mrs.Gleason. She understood my situation and sympathized with me. Long story short, I had to be in court in 3wks with that creditor. I was terrified. I got my letter in the mail about my filing for a chapter 7 the day before court. Whew! Barely made it. I took the letter in to court and judge released my funds and they did not get a dime….oh an this creditor was seeking payment for something 12yrs old… Just crazy! I am so thankful for Gleason and Gleason they were a God send!

My ex husband has used them 3 times . LS

Gleason and Gleason have represented me in the most professional and respectful manner I could ever have expected. They have empathy and compassion for their clients. I can’t imagine a better law firm and highly recommend them. Thank you Troy for your kindness and assistance. You rock!!! – PC

Gleason and Gleason are the best! I was nervous at first but after talking to Troy he put my fears at ease…I am so glad I used this firm and I reccomend this firm…it was a pleasure to work with them. – DC

Gleason and Gleason saved me and my wife and our home. Mr. Gleason took time to explain our options to us and answer all of our questions. Mr. Gleason made the process simple and it went fast. Thank You! – MM

I am so glad I went with Gleason and Gleason to file my Case! Troy Gleason was so welcoming and reassuring! Helped me every step of the way. Through the entire process! Would recommend this Law office to any and everyone – DW

He had all of the answers was very informative and gave me options we’ll be giving them a shot I’ve had a lot of good referrals at least four and see the results of how well they’re doing now I want to work so I will be giving him a shot and the prices are reasonable – MM

Gleason and Gleason is the best on the Southside, handle my case like a pro! He is fast on responding and always helping in any way. – MO

I just signed up with them and I have peace of mind and it seem like a very honest and I’m happy they’re helping my wife and I – WC

I’ve used them for friends and clients and they were great! – RR

From looking over my shoulder to looking ahead, Troy reassured me to be positive. Thank You! – CB

Very professional. Thousands in Credit Cards gone and the calls stopped almost immediately. – CB

They are the best and are affordable – JJ

Privacy Policy | Terms of Service | Copyright 2002-2022